Business Insurance in and around Des Moines

Searching for protection for your business? Search no further than State Farm agent Tony Weisshaar!

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Tony Weisshaar. Tony Weisshaar relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Searching for protection for your business? Search no further than State Farm agent Tony Weisshaar!

Helping insure small businesses since 1935

Get Down To Business With State Farm

Whether you are a fence contractor a florist, or you own a music school, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Tony Weisshaar can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and buildings you own.

Reach out to the excellent team at agent Tony Weisshaar's office to uncover the options that may be right for you and your small business.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

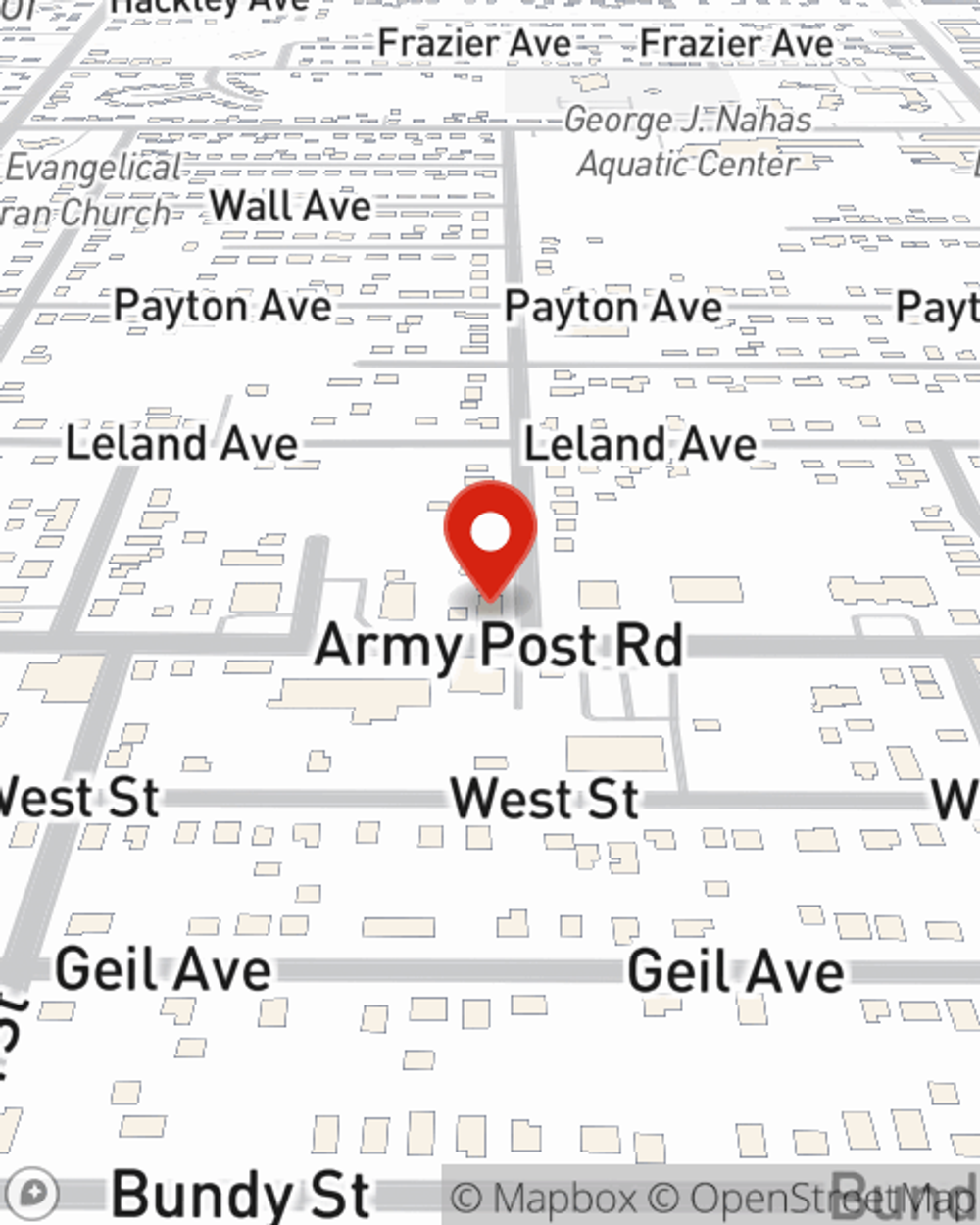

Tony Weisshaar

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.